https://www.bloomberg.co.jp/news/articles/2022-05-26/RCHBM2DWRGG701

ロシア中銀が再び利下げ、政策金利11%-追加緩和も示唆

Paul Abelsky2022年5月26日 17:15 JST

Bloomberg News2022年5月26日 16:31 JSTUpdated on

- ウクライナ侵攻後の金融防衛策を解除、ルーブル高を抑える目的も

- 今後数回の会合での利下げ排除せず-外的環境は依然厳しい

ロシア中央銀行は26日、約1カ月で3回目の利下げを実施し、追加利下げも示唆した。ウクライナ侵攻後の金融防衛策を解除するとともに、ルーブル高を抑える目的とみられる。

中銀は臨時会合で、政策金利を14%から11%に引き下げた。同中銀は前日に会合を緊急開催することを明らかにしていた。ブルームバーグのエコノミスト調査で23人全員が利下げを予想したが、大方は2ポイントの引き下げを想定していた。

中銀は声明で、「今後数回の会合での利下げ見通しを排除しない」と表明。ルーブル高がインフレ低下に寄与したとしたものの、それ以上は相場に言及しなかった。

「ロシア経済を取り巻く外的環境は依然厳しく、経済活動をかなり制限している」とする一方で、「金融安定へのリスクは幾分低下し、一部の資本統制措置の解除が可能になった」と説明した。

予想よりも迅速なインフレ低下が利下げを可能にしたが、中銀にはルーブル高を阻止したい考えもある。4月には2回の3ポイント利下げを実施しており、ロシアがウクライナ侵攻を2月に始めた後の緊急利上げ分の大半を巻き戻した。

原題:Russia Cuts Rates Again and Takes Aim at Ruble’s Rebound (1)(抜粋)

Russian Rate Cut Tops Forecasts, Sends Ruble Rally Into Reverse

- Third straight reduction takes aim at ruble’s rebound

- Currency’s gains concern the Kremlin, imperil budget revenue

Bloomberg News2022年5月26日 16:31 JSTUpdated on

Russia’s central bank delivered its third interest-rate reduction in just over a month and said borrowing costs can fall further still, halting a rally in the ruble as it unwinds the financial defenses in place since the invasion of Ukraine.

The Bank of Russia lowered its benchmark to 11% from 14% on Thursday at an extraordinary meeting it announced only a day earlier. All 23 economists surveyed by Bloomberg predicted a reduction, with most forecasting a cut of two percentage points.

The pace of ruble losses quickened after the announcement, heading for a two-day slump that’s approaching 12% against the dollar.

After nine percentage points of easing since April, central bank Governor Elvira Nabiullina said she still sees room for further rate cuts at meetings ahead. In a statement accompanying the decision, policy makers made little mention of the ruble beyond noting the exchange rate contributed to slower inflation.

“The coming quarters won’t be easy,” Nabiullina said at a banking industry conference, according to Tass. “While the economy is adapting it will be hard for companies and citizens.”

Dialing Back Defenses

The Bank of Russia has reversed most of the tightening imposed since the invasion of Ukraine

Source: Bank of Russia, Economy Ministry

Encouraged by a faster-than-expected slowdown in inflation after shocks to demand, the decision shows the central bank’s determination to get in the way of the ruble’s blistering ascent even as the capital controls continue to handcuff the market. With the latest rate cut, it’s now reversed almost all the emergency monetary tightening after the invasion of Ukraine three months ago.

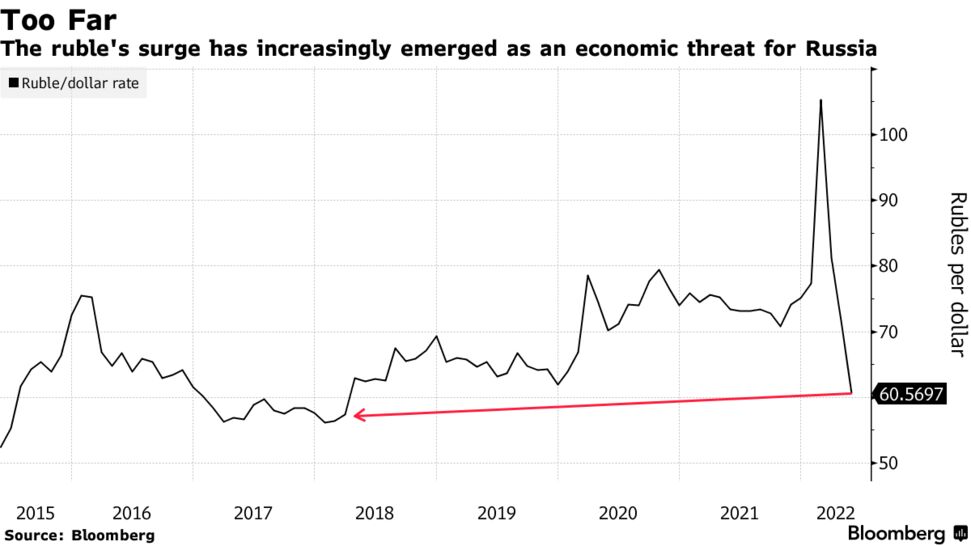

Despite the sweeping sanctions imposed on Russia, surging exports and capital controls have sapped demand for foreign exchange and sent the ruble soaring to the highest levels since 2018. Efforts by the authorities to slow the gains, including the easing of key capital controls earlier this week, so far haven’t helped much.

Stringent restrictions remain in place. Since the invasion, capital controls have made it impossible to sell assets and repatriate the proceeds.

In anticipation of deeper monetary easing, the ruble weakened sharply on Wednesday after gaining for five straight trading sessions. It tumbled for a second day after the decision and weakened as much as 7.9% against the dollar, the biggest drop on an intraday basis in more than two months.

Still, investors were skeptical about how much policy makers can do to keep the gains from resuming because the ruble’s exchange rate is now almost entirely determined by the trade balance.

“I do not think that the decision of the central bank will help to weaken the ruble in the absence of a carry trade,” said Dmitry Kosmodemiyanskiy, an asset manager at Otkritie. “Everyone sees the trade balance and only a madman would play against it.”

The central bank also wants to provide a shot in the arm to an economy that’s on track for a sharp contraction. With the collapse in consumer demand, weekly inflation is slowing after a run-up in prices because of a spate of panic-buying in the months immediately following the invasion.

What Bloomberg Economics Says...

“Further easing is likely in the months ahead. A soaring ruble and a sanctions-hit economy provide the urgency, while stable financial markets and fading price pressures are freeing policy makers to act.”

--Scott Johnson, Russia economist. For more, click here.

President Vladimir Putin has touted the ruble’s strength as a sign that the country has survived the unprecedented sanctions imposed by the US and its allies to punish Moscow for its invasion of Ukraine.

But Russia’s oil and gas exports are mostly exempt from the penalties, sending billions of dollars and euros flowing into the country each week. Dwindling imports and restrictions on buying and sending funds abroad, meanwhile, have all but eradicated demand for hard currency.

Hawkish Stance

Some 60 central banks have hiked rates this year

Source: Bloomberg

Note: Mapped data show change in interest rates in basis points for distinct central banks since the start of 2022.

Enough pressure built on the ruble in recent days to prompt speculation that the central bank moved up a planned rates meeting by more than two weeks to Thursday in order to temper the strongest currency rally globally.

Restrictions on the movement of capital mean “rates have becomes quite irrelevant to the dollar-ruble dynamic,” according to Cristian Maggio, head of portfolio strategy at TD Securities in London who correctly predicted the decision.

“This means you may not see much ruble depreciation from here,” he said. Still, “more cuts are likely in the cards.”

— With assistance by Paul Abelsky, and Harumi Ichikur